Queensland’s luxury market looking up this spring

Queensland’s luxury and holiday property market continues to favour buyers, with sellers forced to significantly drop their price expectations after the global financial crisis.

But agents say that this spring, things are looking up.

“The luxury market in Queensland has changed quite dramatically in the past six months,” says the Director of Unique Estates, Nicolette van Wijngaarde.

“After four years of GFC and many high-end buyers sitting on their hands, the market is now considerably more buoyant.”

The impact of the GFC compelled vendors Catherine and Ron Lightfoot to drastically reduced price expectations for their stunning Whitsundays property.

“We bought the property for $1.34 million in 2007 and invested $200,000 in renovations,” said Ms Lightfoot.

Property data shows there were hopes of $1.5 million in 2008.

“We have had to drop our price expectation to meet the market,” she said.

“Shute Harbour is relatively unknown and regional Queensland was hit hard during the GFC.”

New Queensland laws mean sales agents are unable to give a specific price guide for properties up for auction. Only comparable sales are allowed to be supplied.

But according to PRD Senior Sales Consultant Robert Taylor, the Lightfoots weren’t the only vendors forced to accept the market conditions.

“More recently a lovely home at 46 Harbour Ave, Shute Harbour sold for $1,075 million,” said Mr Taylor.

“This would have sold for approximately $1.5 million in better times.

“It just shows now is the time to consider exclusive properties.”

The Domain Senior Economist, Dr Andrew Wilson, agrees that boutique luxury property in Queensland has been, as with most of Australia, subdued, due to the current lack of wealth effect in the economy.

“Activity is not where it was four years ago, especially prior to the GFC,” said Dr Wilson.

“It’s a good time to buy for higher end, iconic style properties in iconic regions.”

Indeed, the Lightfoots’ loss with be a buyers’ gain.

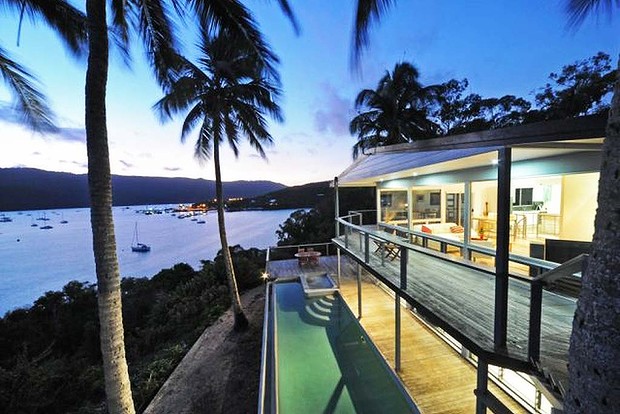

The council-approved holiday rental features a nine-metre infinity pool and heated Jacuzzi, large wrap-around verandas on both levels, as well as the usual mod-cons.

With stunning 270-degree views of both the harbour and surrounding tropical islands, the contemporary waterfront home sits on the tip of a peninsula, at the end of a cul-d-sac and adjacent to a bush reserve.

Ms Lightfoot said the home would suit a variety of buyers including retirees and young couples, as well as investors looking for a holiday home that can also be rented as holiday accommodation.

The three-bedroom house rents out for $500 a night. Or the studio downstairs attracts $325 a night.

“The majority of those who rent it out are honeymooners or people celebrating special occasions,” Ms Lightfoot said.

“Waterfront properties with extensive ocean and harbour views such as this are extremely rare.

It’s up for auction next Saturday, September 6.

“Real estate in Shute Haven is incredibly undervalued at the moment.”

Shute Haven is a peaceful enclave a short eight-minute drive to the centre of Airlie Beach, which is serviced by two airports – Hamilton Island and Proserpine – with frequent flights to and from most capital cities.

According to Mr Taylor, anything waterfront in the area looks to be good value.

“They don’t make any more waterfront and we know from previous sellers markets that the big capital gains come from unique properties with excellent positions,” he said.

“Properties are being secured well below replacement costs.”

Other spots for buyers to take advantage of the current luxury and holiday property market are Noosa, Noosa Hinterland, Whitsundays, Port Douglas and its surrounding hinterland.